Good to Great: Collective Experiences Bring Shopping and Entertainment Districts into the Future

CRTKL’s Matt Billerbeck and Caye Burry explore the trends that will likely appear in malls this year.

Shopping as a cross-generational pastime remains a popular leisure and social activity. But retail is changing at a rapid clip, and the modern shopper is looking for much more than acquisition of material goods and a frictionless transaction. To keep pace, the mall has to be more than an attractive space in which to display products; instead, it needs to create a framework for social interaction.

No one knows this better than Matt Billerbeck, CallisonRTKL Senior Vice President and the firm’s sector leader for Shopping and Entertainment Districts.

“A good shopping mall becomes a great shopping mall when it offers opportunities for collective experiences,” says Billerbeck, who is based in CallisonRTKL’s Seattle office. “We’re setting the stage for a level of engagement that makes the trip memorable.”

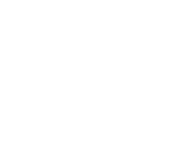

Chadstone Shopping Centre in Melbourne, Australia.

It has been well-documented that when consumers spend money on experiences, they are happier long-term than when they spend money on more “stuff.” When a mall can address the experiential part of the equation, it establishes itself as a highly regarded community asset and a dynamic place that shoppers want to visit again and again.

“Certain retailers really get it,” said Billerbeck. “They’re seasoned veterans in choreographing the shopping experience, from entry to check-out. Shopping centers are undercutting their own potential if they limit the focus to simply providing access to individual brands and a positive business climate. This may keep things simple, neutral and efficient, but it’s not necessarily interesting for shoppers and doesn’t create the kind of spaces that become experiential hubs.”

The New Mall

For all the talk of “experience-driven,” “compelling” destinations and the power of “placemaking”—buzzwords whose superficial application is already suffering from a certain level of exhaustion in the marketplace—successful retail design requires finding a way to transcend of-the-moment trends and truly integrate with the fabric of society.

Equally important is grounding the design in a combination of project experience and data. Consider this: according to TimeTrade, if an item is available online or in a nearby store, 71% of consumers will still buy the product in-store. In a similar report by Neosperience, 64% of shoppers were surveyed as prioritizing their in-store experience above price in their choice of a brand. Meanwhile, RetailNext tell us that 89% of brands compete on the basis of customer experience.

What do these figures mean for the mall?

“My sense is that major retailers will begin to expect shopping malls to raise the bar for the experience that takes place beyond the individual retailers’ front doors,” said Billerbeck. “Access to parking, a good lease deal and a few select amenities will no longer be enough to attract tenants. They will expect the shopping center to make their target consumer comfortable, and to offer a more effective and seamless segue to their brand experience by establishing a level of continuity between the center and the store.”

Time is Money

For today’s shopper, money and time are equally significant expenditures; both represent precious personal equity. While there is still a lot to be said for functional efficiency, when shopping is about the experience, it becomes more about luxuriating. Specific design elements that enhance shopper comfort and convenience—furniture, wayfinding and gathering places for dining, relaxing and recreation—are best tailored in a way that makes shopping centers feel less generic and boosts dwell time.

Roosevelt Field shopping center in Garden City, New York.

Yet efficiency is still very much a part of the equation, and technology is assisting in a big way. Currently, fulfillment centers are a hot topic of conversation among developers. Should retail stores operate only as showrooms and fitting rooms with fast delivery service originating from a point outside the retail space? That depends. While some have explored this model, giving the concept a try can be a tricky proposition as brands look to go up against big competition (like Amazon Prime).

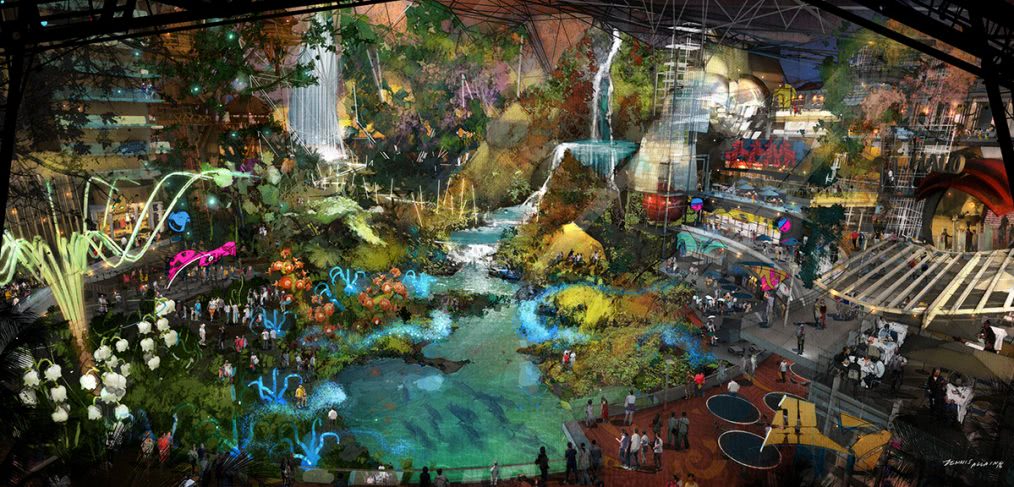

But where technology comes into play, efficiency comes wrapped in a more discerning package. Next generation point-of-sale—in other words, the most innovative ways to facilitate quick and easy transactions—are aimed at more than just consumer convenience; it’s a way for retailers to discover who their shoppers are and use that data to improve the in-store experience.

“The basic interface for these tools isn’t even all that sophisticated; it’s already been implemented in airports and hotels,” said Billerbeck. “Now it’s being reinvented for the retail environment, and it opens up a plethora of user interface design opportunities.”

Consumer comfort level with trading privacy for efficiency and convenience is still somewhat dubious. However, research suggests that the notion of trading basic information for a better experience is relatively palatable: a study by Aimia found that 80% of consumers are willing to share their name, e-mail address and nationality with brands.

“In the end, retailers are really just looking for new ways to interact and have a more impactful conversation with the consumer,” Billerbeck said.

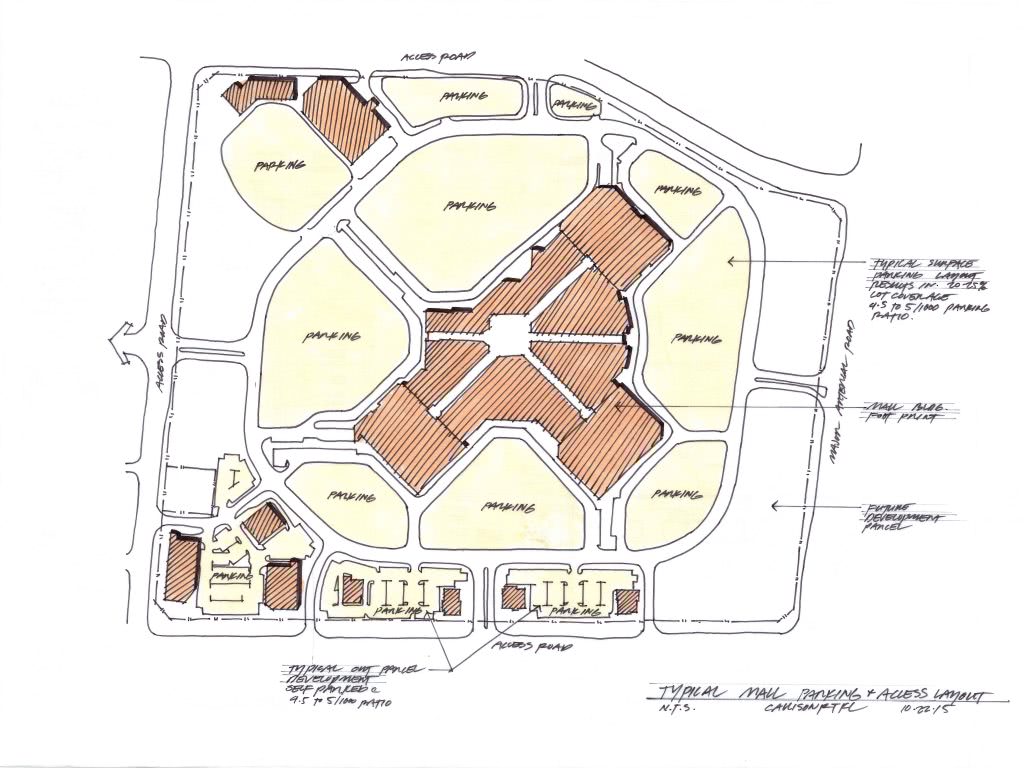

And what about the most dreaded part of the shopping mall trip: finding a parking spot?

“Everyone is asking about driverless cars right now,” said Billerbeck. “While they will definitely be a big disruption to shopping center design, I think we are still a ways out from that being the reality. When it does come online, the question will be what to do with surplus property. If there is more value to be had, then it’s a simple build-out; outside of that, it will be interesting to see what happens. Open space is an option, and multifamily residential can work very well, too. It’s all market-driven, so it will depend on context.”

The typical mall parking and access layout could change dramatically as technology evolves.

The Shrinking Entertainment Dollar

In the competition for the shrinking entertainment dollar, malls admittedly have an uphill climb. Major entertainment venues like the Staples Center in Los Angeles and Barclays Center in New York City are structurally well-run and deeply entrenched in local culture. Malls shouldn’t look to recreate entertainment on this scale, but they can expand their programming—paid and unpaid—to keep things fresh and exciting.

In retail spaces, luxury theatre offerings that combine dinner and movies, indoor golf, cooking classes, family-friendly activities, and recreational spaces and activities centered on fitness and healthy living are all becoming more commonplace. The future shopping center will find innovative ways to about enhance and expand upon the current prototype; for example, Westfield purchased New York-based Scott Sanders Productions—the Tony Award-winning producer of Broadway’s The Color Purple—to help choreograph programming across their entire asset chain and bring more people into their shopping centers.

MIddle East Retail Entertainment Destination

“Overall, the definition of entertainment is expanding and the possibilities are endless,” said Billerbeck. “It’s a great way to integrate the shopping center into the community and local culture—to inject authenticity into a historically sterile environment.”

Coming 2017

The bottom line for 2017 shopping center design trends? More momentum building along the lines of current trends. Retail tenants and shopping center developers who recalibrate, optimize the relationship between bricks and clicks and figure out their niche in the space where the modern shopper exists will ultimately be the most successful.

“The traditional department store’s influence will give way to the next-generation retailers—brands like Warby Parker, Bonobos and Apple—who have it figured out; they will continue to experience accelerated growth in-store,” said Billerbeck. “Accommodating these game changers means getting a lot smarter about designing and managing malls to support and reinforce the consumer experience both in and out of store. Retail will take big cues from the hospitality industry in order to do that.”

———————————————————-

Matthew Billerbeck

Matthew Billerbeck

Matt Billerbeck leads the shopping and entertainment district sector for CallisonRTKL. Matt has spent more than 20 years planning and designing retail and mixed-use projects around the world. His expertise includes guiding the design and roll-out process for large-scale domestic and international retail developers. As the link between the client and design team, Matt ensures a client-driven process so the design team’s agenda is in line with the developer’s agenda.