Healthcare in 2018–Where Do We Stand?

A new year is knocking on our door and nobody is any closer to knowing where healthcare in the United States is heading. The repeal of the ACA? A legislative new frontier? Insurance giants being gobbled up by retailers? Well, no one said it’d be easy. CRTKL Vice President Eric Dinges has been monitoring the weather and has some advice on keeping the ship moving forward, no matter how the wind blows.

Legislative, industry and political changes have made everyone understandably anxious about healthcare, and nothing that has happened in the last six months has revealed any magical answers. Large healthcare organizations and industry insiders are following events as they unfold, but most everyday Americans are generally in the dark about what will happen to insurance, benefits and their access to healthcare services.

For us—a global architecture practice that wants to see its domestic healthcare work grow and diversify—navigating the currents and tides is no small feat. When the industry hunkers down because of uncertainty, or the potential for America to cede its place in the world as a leader in medicine, research and technology, the consequences are felt not only in business but in society. In other words, it behooves us all to sort this out.

First, some context. One of the great tragedies of the U.S. healthcare market is that it has become inextricably politicized. Currently, the GOP controls the White House, the House and the Senate, which translates into 61% of Americans holding them responsible for the fate and future of healthcare. But, it’s important to remember that these unified terms rarely last; in fact, since 1990 (that’s almost 30 years ago, if you can believe it), one party has controlled all three houses for only eight of those 30 years. That means every election, especially the mid-terms, has a substantial impact on how the issues are settled. Two steps forward, one step back. Repeat.

The ACA Then and Now

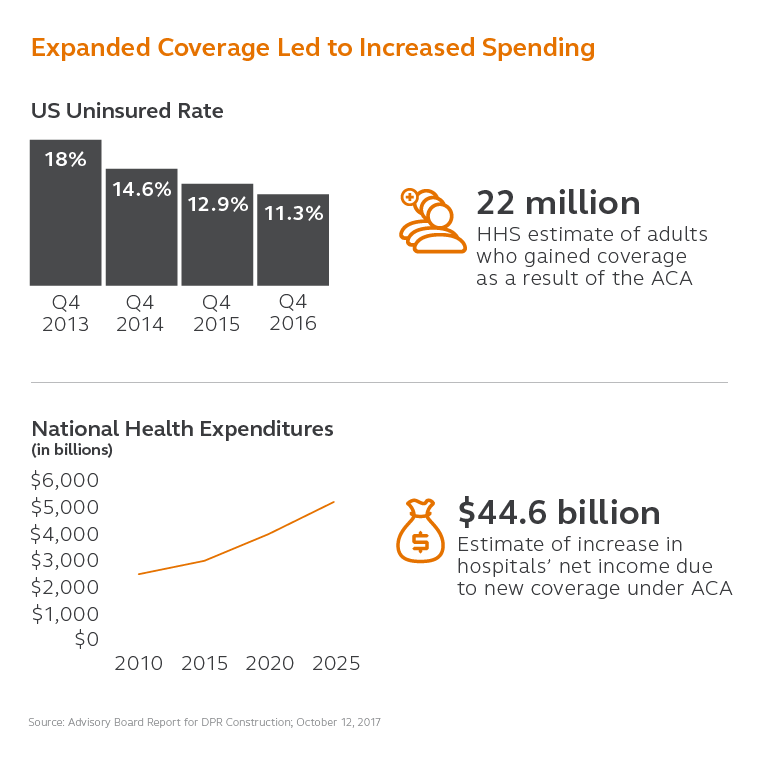

We can’t talk about healthcare legislation without talking about the Affordable Care Act. Whatever you may think of it politically, there’s no question that the ACA increased the number of Americans with health insurance coverage. That also means that it increased healthcare spending significantly.

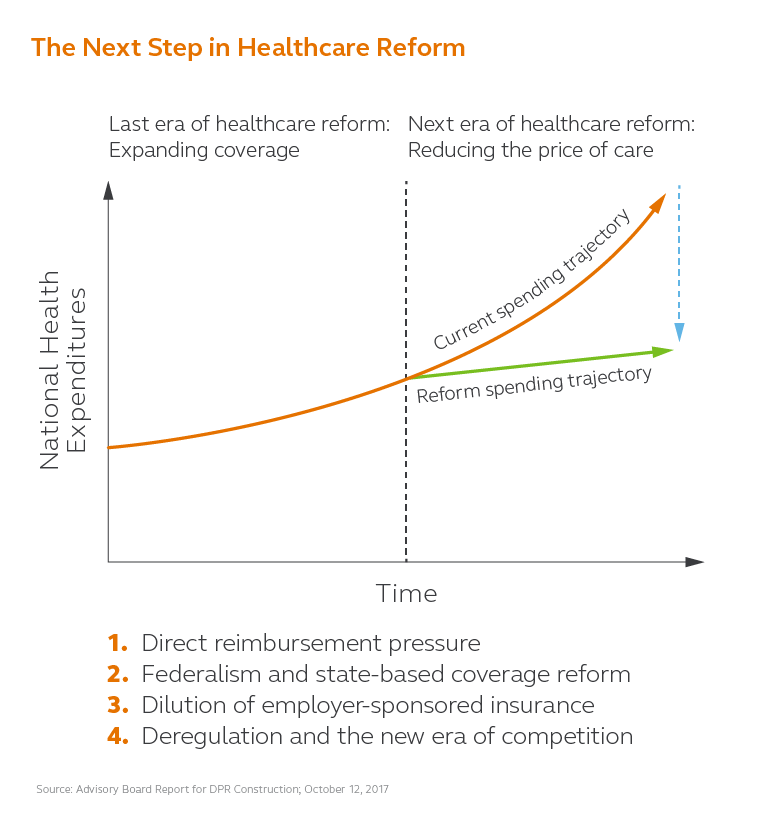

The ACA and the Obama Administration focused on expanding health insurance coverage and access, as well as reducing costs where possible. The current reforms being discussed are much more focused on reducing healthcare costs with the potential of significantly reducing coverage and access, and that has healthcare organizations concerned and re-thinking their capital expense strategies for the next few years.

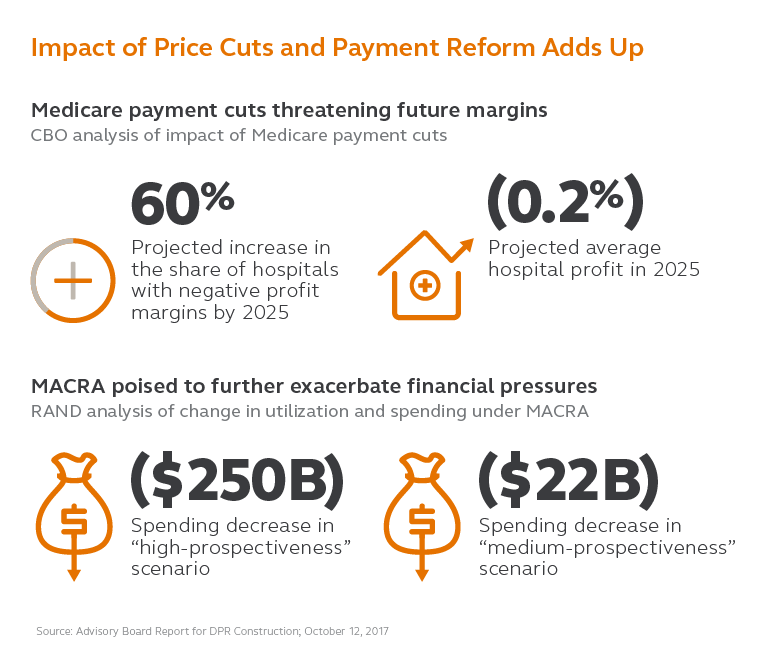

The tax law passed at the end of 2017 includes billions of dollars of cuts to Medicare, and these cuts threaten future healthcare margins, according to the nonpartisan Congressional Budget Office (CBO), so hospitals, clinics and providers need to stay actively engaged in providing expertise and evidence-based solutions to lawmakers.

The GOP budget proposal also includes a $1 trillion cut from Medicaid over the next ten years when 31 states are already facing revenue shortfalls. At the same time, 33 States (including DC) have approved Medicaid expansions, leaving the potential for a catastrophic gap between funding and costs. It’s unknown how this gap will be reconciled and unclear whether proposed regulation will address it.

The Great Deregulation Debate

Nearly half of the US population is covered by employer-sponsored insurance, and the cost of that continues to grow. Where Medicare and Medicaid typically pay providers under 90 cents on the dollar, private insurance has historically paid $1 to $1.50, offsetting this loss.

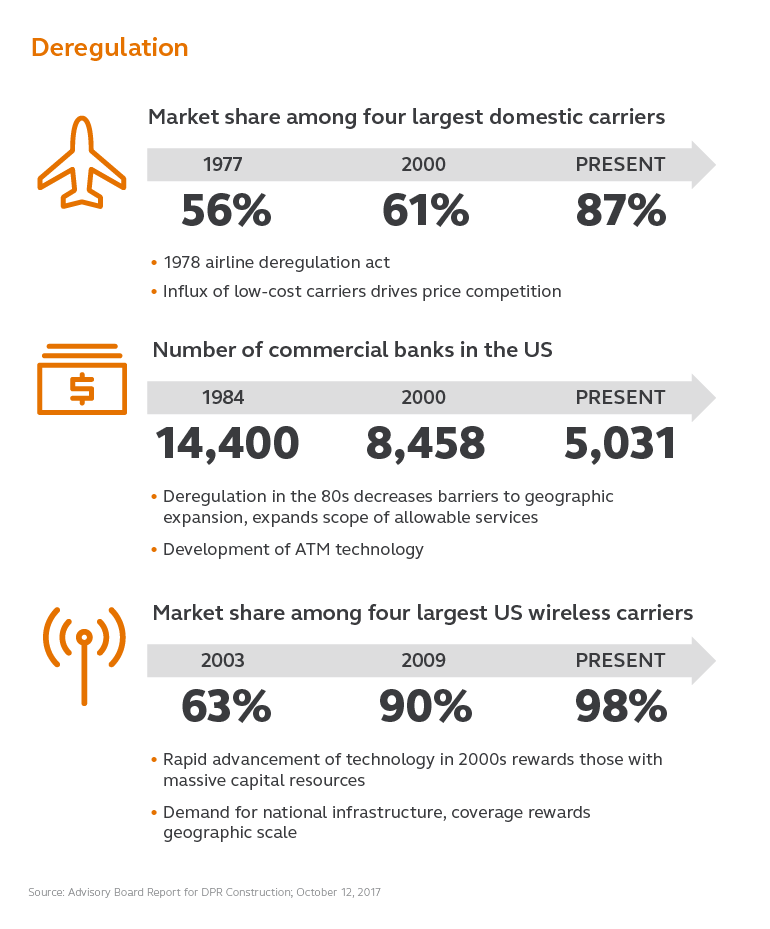

If you look at industries outside healthcare, deregulation is often favored by businesses but frequently comes with a hefty cost to consumers, especially when it decreases competition and choice.

It’s not difficult to see the potential for deregulation to do the same thing to the healthcare industry. Already, the market share for the biggest players is increasing. And, for patients, if they only have access to a single provider, it can mean sub-standard care that is more about cutting costs than it is about improving lives and positive outcomes.

The news isn’t all bad, though. Many economists and industry experts argue that deregulation can also lead to lower prices for consumers, particularly in an industry over-burdened by administrative complexity and bureaucracy. Deregulation can lead to streamlined infrastructure improvements across the board and improved delivery models as finding efficiencies becomes imperative. These more positive changes typically take time, however, and in a life-or-death field like healthcare, time is a luxury that many people—and many politicians—don’t have.

5 Key Takeaways for 2018

So far, industry consolidation has added costs to the system. At some point, the healthcare sector will have to come to terms with these costs and pull inefficiencies out of the system without sacrificing patient care. And they will likely need to find a new way to deliver that care, closer to the patient and with less transactional friction. CVS’s recent purchase of Aetna signals just such a move. Sadly, obtaining healthcare may never be as easy as buying a pack of Tic Tacs, but we may be heading in that direction.

So, where does that leave us? Still a bit confused, but a few things seem solid:

1. Stop worrying about legislation.

It seems inevitable that the Trump administration will make cutting federal spending on health care a priority and give states more latitude to make decisions. Organizations may want to focus less on legislation, which is a fluid and fickle concept these days, and go back to basics—giving patients choices, being transparent about costs and providing great care will go a long way with consumers, who are becoming more sophisticated on how they procure their care.

2. Health systems and providers should focus on costs, not prices. The U.S. spends almost twice the amount on healthcare as comparable countries, even though Americans use about the same amount of care. Why? Prices. And that has to change. But if providers can lower costs, it’s what will lead to profitability and growth, regardless of political shifts.

3. Public v. Private Reimbursement? More like Millennials v. Baby Boomers. As more Baby Boomers qualify for Medicare, we can’t forget about the changing healthcare needs of Millennials. We’re still far from accepting universal healthcare as an acceptable alternative but it continues to sneak out from under the bed whenever people discuss the future of the industry.

4. Creative thinking will revolutionize healthcare. Whoever comes up with a sustainable, creative solution to controlling costs and allowing for growth will own the industry. We also predict a change in delivery methods as retailers (CVS, for one) get in on the game and disrupt the industry. Not all of these solutions will work, but the ones that work best will likely change how we all receive care for the foreseeable future.

5. Be Lean. Healthcare providers and operators need to remove inefficiency from the system. Like all things these days, the transactional equation is changing and the driving factor will almost certainly be operational efficiency. While almost everyone disagrees on how to fix healthcare in this country, no one disagrees that it needs to be fixed. And most of that “fix” has to do with the administrative sclerosis that has clogged every artery, vein, and capillary of the corpus.